Palm Bay Real Estate Pauses, But City’s Growth Strategy Accelerates

Palm Bay’s real estate market has flattened. As statewide foreclosure risks rise, how will the city’s aggressive growth strategy impact local affordability?

The Market Pause Masks a Deeper Story of Policy and Growth

Palm Bay, FL – The Palm Bay real estate market has entered a new phase of equilibrium, with home prices flattening after a multi-year surge. This pause, however, masks a period of intense, policy-driven development. As the city navigates a statewide foreclosure crisis and a local affordability crunch, the core question is whether its long-term growth strategy can deliver stability or if it will deepen the divide for residents.

The Market Pause and Foreclosure Question

After years of rapid appreciation, the housing market has cooled into a soft correction. The median sale price is approximately $330,000, a figure that represents a year-over-year decline of about 4.1%.

Properties are also taking longer to sell, averaging 60 to 70 days on the market. This slowdown is coupled with a rising supply of homes, which reached 4.4 months in the third quarter of 2025, moving the market closer to balance.

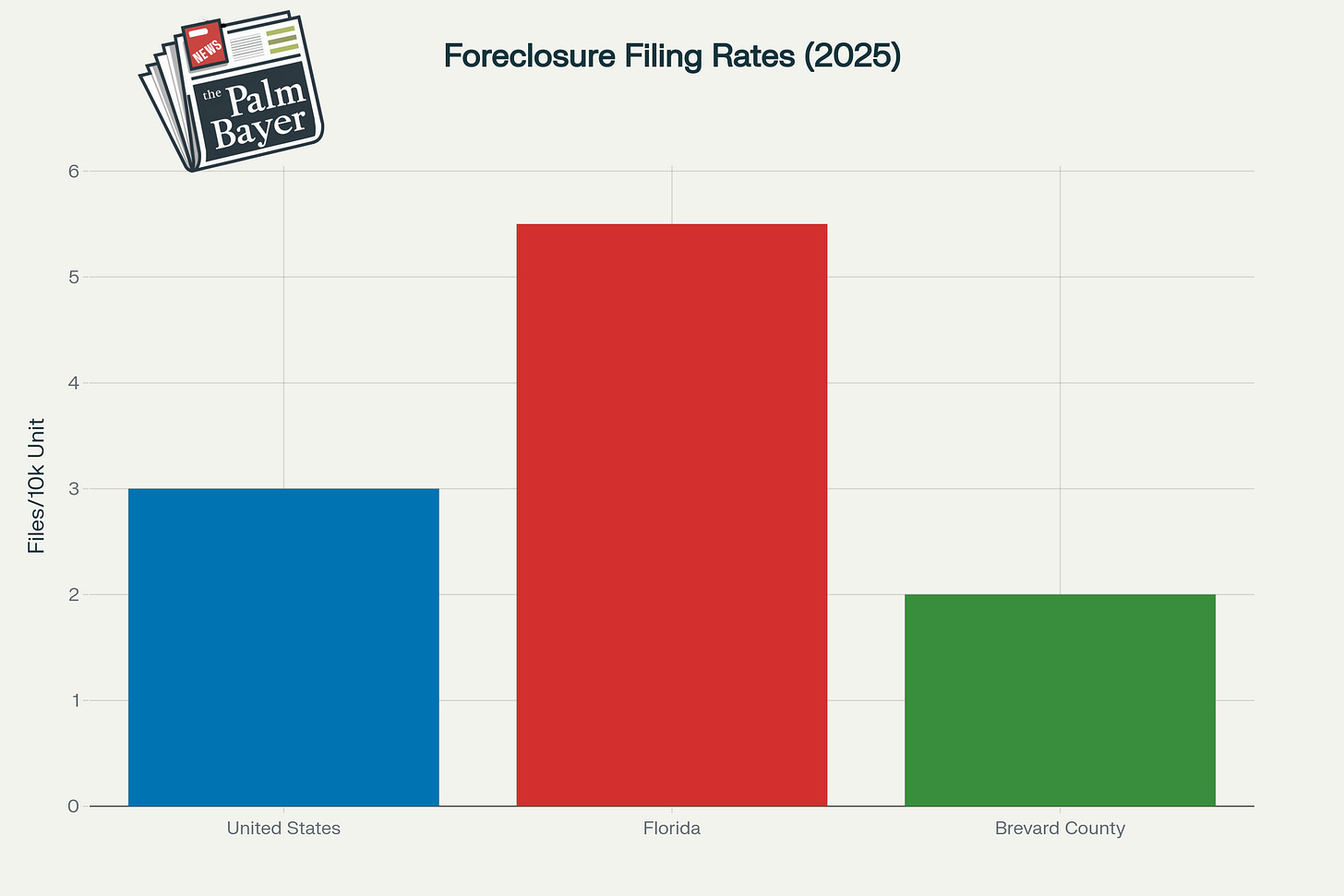

This local stabilization is occurring against a troubling backdrop. According to just-released October 2025 data, Florida has the highest rate of foreclosure filings in the nation.. Florida’s rate is one in every 1,829 housing units—a 19% jump from the previous year.

So far, Palm Bay appears insulated, with distressed sales making up less than one percent of all transactions. This insulation is supported by city-administered stabilization programs, including federal CDBG and HOME funds, as well as the state’s SHIP program. These resources provide a crucial safety net, offering aid for housing rehabilitation and down-payment assistance to income-eligible residents.

Affordability Crisis Meets City Policy

The most significant pressure point for residents remains affordability. While rent growth has finally flattened, the average rent in Palm Bay sits near its historic high of $1,881.

This follows years of rent hikes that far outpaced local income growth, leaving over 50% of renter households “cost-burdened,” paying more than one-third of their income for housing. It is important to note that portions of this income growth may be attributable to Florida’s phased minimum wage increases rather than organic wage gains across all occupations.

The city is actively responding, though it is taking a selective approach. Palm Bay is deploying federal and state funds for several key projects:

Space Coast Commons: A 34-unit affordable housing development.

Bilda Apartments: A recently approved 48-unit affordable rental project.

Habitat for Humanity: Funded for the construction of five new affordable single-family homes.

Community of Hope: Awarded funds to acquire 14 units for transitional housing.

In a significant policy move, the City Council first approved Resolution 2024-46 on December 19, 2024, opting out of the tax exemptions offered by Florida’s Live Local Act for middle-income affordable housing (80-120% AMI). The opt-out was renewed at the November 6, 2025 council meeting, as required annually under state law. City officials based the decision on a Shimberg Center report indicating the metro area has a surplus of housing in the 80-120% AMI bracket

The ‘Why’ Behind Palm Bay Real Estate’s Industrial Boom

While the residential market pauses, Palm Bay’s commercial and industrial real estate sectors are being actively reshaped by city policy.

The commercial market is “bifurcated.” Older retail strips struggle, while new retail development is booming, driven almost entirely by massive new mixed-use projects. The 353-acre Lotis Palm Bay development, for example, is approved for over 100,000 square feet of commercial space.

This growth is not accidental. It is the result of a “lock-and-key” strategy where the city grants zoning approvals in exchange for developers funding and building essential, large-scale public infrastructure. For Lotis, this includes building new wastewater and water service utilities to the site. Crucially, the developer is also required to construct the extension of the St. Johns Heritage Parkway from the existing I-95 interchange south to Micco Road, opening up a vital new corridor in the southeast.

The industrial sector is the city’s clearest economic focus. Palm Bay is leveraging its Economic Development Ad Valorem Tax Abatement Program to attract high-wage, high-tech employers.

This strategy has secured major, tangible investments:

L3Harris: A recently completed $100 million expansion of its Palm Bay satellite facility. This 94,000-square-foot addition, finished in August 2025, is dedicated to the “Golden Dome” national missile defense program.

Rogue Valley Microdevices: A $70 million-plus investment to build a pioneering semiconductor foundry, supported by a $6 million federal CHIPS award. The facility was scheduled for completion by mid-2025 and is expected to be fully operational shortly.

The city is actively promoting underdeveloped areas like “The Compound” (Unit 53) and the new EYP Holdings Business Park to land similar high-tech tenants.

A Strategic Bet on Growth

The “pause” in the Palm Bay real estate market is deceptive. Below the surface, the city is executing a clear and aggressive strategy: trade zoning for infrastructure, use tax incentives to land high-wage jobs, and manage the resulting affordability crisis with targeted federal and state grants.

The forward look for residents is defined by this strategy. Key variables like high mortgage rates and insurance costs remain significant pressures. The city is betting that a future anchored in high-tech industry will create prosperity that outweighs the immediate and severe affordability gaps.

As these new industrial projects spin up and massive mixed-use developments break ground, the next 12 to 18 months will reveal whether this strategic bet pays off for all of Palm Bay’s residents.

Finally, a sustainable plan!! 🙏🏼

Thanks Tom