Palm Bay Tax Increase Proposed to Fund Public Safety

Palm Bay officials are proposing a property tax increase for Fiscal Year 2026 to fund critical public safety needs, raising questions about the city's voter-approved spending cap.

Council to Weigh Public Safety Needs Against Tax Cap

Palm Bay, FL – The Palm Bay City Council will hold its final public hearing on the city's Fiscal Year 2026 budget this Wednesday, September 24, at 6:00 PM in the Council Chambers on Malabar Road. At the center of the debate is a proposed $521.3 million budget and an associated Palm Bay tax increase, which pits the city's stated need for public safety funding directly against the voter-mandated spending cap.

The proposed operating millage rate is 6.7000 mills. While this rate is slightly lower than last year's 6.7339 mills, it would generate more revenue for the city than the charter's 3% cap allows. This 'tax increase' refers to the city collecting more total property tax revenue than the cap permits, not an increase in the tax rate itself.

A "Critical Need" for Public Safety

To legally exceed the 3% cap, a supermajority of the City Council must declare a "critical need". According to city documents, this declaration is required to address funding deficiencies for essential public safety assets.

The specific items cited include:

Three Quint Fire Trucks with 75-foot ladders to replace vehicles that are over two decades old.

One new Heavy Rescue vehicle for the Fire Department's specialized Technical Rescue Team.

Twenty-four new Police vehicles to replace aging fleet inventory and vehicles lost to damages.

This is not the first time the city has used this provision. In Fiscal Year 2023, the council invoked a critical need to adopt a rate of 7.5995 mills to fund public safety and road maintenance. Voters enacted the 3% cap in 2016 and reaffirmed it in 2022 when a measure to repeal it failed.

Budget Adjustments and Capital Plans

The total proposed budget of $521,271,358 reflects a 1.07% increase from the initial FY 2025 proposed budget. Since the budget was first published in July, the city has made several adjustments. Notably, the General Obligation (G.O.) Road Program Fund saw an increase of nearly $4.6 million to provide additional funding for paving in Project 23G003 - PMU 45.

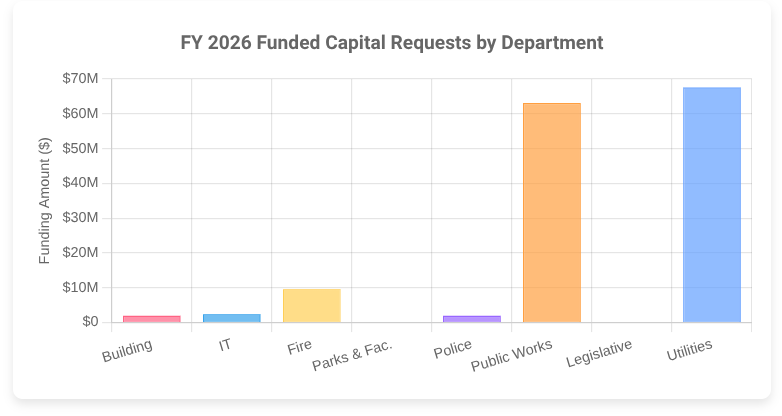

The budget also includes the adoption of the city's five-year Capital Improvements Program (CIP). For Fiscal Year 2026, the CIP allocates $146.5 million for funded projects across eight city departments. However, there remains a significant gap, with over $15.3 million in requested projects going unfunded for the upcoming year, including $6.4 million in the General Fund alone.

In separate votes, the council will also decide on proposed rate increases affecting a range of city services, including fire safety inspections, building permits, summer day camps, and water utilities.

The council's final vote will set the city’s financial course for the next year. The decision presents a clear choice: override the charter's spending cap to immediately fund new fire trucks and police cars, or adhere to the voter-approved limit and defer those expenses.

Cause and effect, when it comes to safety our sidewalks are an item that deserves consideration, some people park their cars on them, the city should re-evaluate the criteria for them. they should be elevated to the crown and contoured for safety, as our need for infrastructure. Why not do our VAST projects completely instead of half VAST

My wife and I are relatively new to the Palm Bay Area. We have been enjoying the southern climate, but we are becoming increasingly concerned about what seems to be a declining financial debacle here in Palm Bay. It seems that every article in the PB’er seems to focus on increasing taxes and the dire need to do so.

In my opinion, the area is way too spread out geographically (86 square miles) and with low density population this amounts to not enough taxes being collected to feed the required infrastructures. This pattern started decades ago when roads were being created for the traffic at the time with a disregard for future population growth. While most residents like the low density population, the city is hurting and struggling trying to stay afloat. Ultimately the residents are becoming more disgruntled for the need to constantly expect them to foot the bill.

Unfortunately, if the current roll call of residents cannot afford to “foot the bill” then the governing body must approve projects that will decrease the need to raise residents current taxes. Hopefully, the group in charge will learn from past experiences. Perhaps by adopting a more aggressive pursuit where incoming business and housing development will pay for the increased infrastructure support that they will require.

Finally, I have a question which I believe many people also need an answer. What is the “mileage rate” and how does that number get generated? Show us the math!