🏡 Palm Bay Housing Market: Navigating the Shift - What Buyers & Sellers Need to Know in 2025

Palm Bay's real estate scene is cooling. Expect more homes for sale, longer selling times, and price adjustments. 📉

Palm Bay, FL - Recent market analysis indicates the local real estate market is undergoing a significant recalibration. This shift details a transition from a period of rapid pandemic-era expansion to a more subdued environment characterized by increasing inventory and emerging price pressures. While a 2008-style crash is considered improbable, a continued market correction is the most likely scenario for the near term.

🌡️ Market Temperature: Key Indicators Point to Cooling

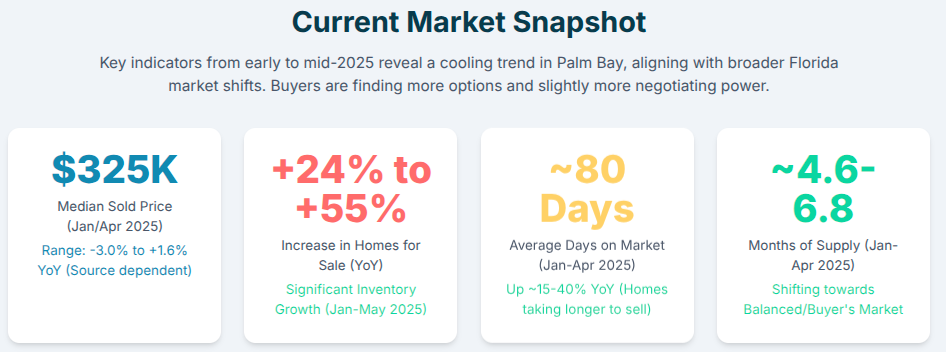

Recent data from early to mid-2025 paints a clear picture of a decelerating market in Palm Bay. Here's a snapshot of key indicators based on various market reports:

Palm Bay is seeing more homes listed with price reductions, a clear sign sellers are adjusting to a less frenzied market. For example, Realtor.com noted Palm Bay among the top 10 U.S. metros for price cuts in April 2025.

The supply of homes for sale has grown considerably, giving potential buyers more options and negotiating power than in previous peak years.

🤔 What's Behind the Shift?

Several interconnected factors are contributing to Palm Bay's current housing market dynamics:

Affordability Squeeze: The combination of previously high home prices, elevated mortgage rates (generally 6-7% in early 2025), and dramatically rising homeowners insurance costs are making it harder for buyers. Florida's average home insurance premium is projected to reach $15,460 by the end of 2025.

Economic Undercurrents: While the local job market has shown resilience, particularly in tech and manufacturing, some major aerospace employers have announced layoffs. The construction sector has also seen an employment contraction, which can be a leading indicator of building slowdowns.

Changing Migration Patterns: While Palm Bay continues to attract new residents, the intense wave of in-migration to Florida seen during the pandemic has slowed. This easing of demand contributes to the overall market cooling.

New Homes Adding to Supply: A significant amount of new construction has been underway in Palm Bay. This adds needed housing but also increases overall inventory, which can pressure prices if demand softens.

Here's a glance at some of the cost pressures affecting the market:

📉 Correction vs. Crash: Understanding the Current Climate

It's crucial to differentiate the current market "correction" from a "crash" like the one experienced in 2008.

A correction typically involves a moderate decline in prices (perhaps 5-15%) from peak levels, an increase in inventory, and a shift towards a more balanced or buyer's market. This is often a natural adjustment after rapid price surges.

A crash involves severe, prolonged price drops (30% or more), widespread foreclosures, and significant economic recession. Current market fundamentals, like tighter lending standards, and healthier homeowner equity, make a 2008-style scenario unlikely.

While Palm Bay is part of Florida's broader cooling trend, some analyses suggest it might see more noticeable price adjustments. For instance, Reventure App forecasted a potential -6.74% price decline for Palm Bay in 2025, on top of an existing year-over-year dip.

🔮 Future Outlook: What to Expect (2025-2027)

Based on current trends and expert analysis, Palm Bay's housing market is likely to see:

Continued Cooling (Most Likely for 2025-early 2026): Expect inventory to keep rising moderately, homes to stay on the market longer, and prices to experience modest declines. Buyer's market conditions will likely become more established.

Price Stabilization (Potentially Mid-2026 onwards): After the correction phase, prices could find a floor and stabilize. This would likely require some easing in mortgage rates and a response from builders to current inventory levels.

Rebound (Less Likely in the Short Term): A significant rebound would need substantial improvements in affordability (e.g., major drops in mortgage rates or insurance costs), which doesn't appear imminent.

🗺️ Navigating the Market: Advice for Stakeholders

This evolving market requires different strategies for different players:

For Prospective Buyers 🛒

Exercise Patience and Negotiate: With more homes available and sellers more willing to deal, take your time and don't be afraid to negotiate on price and terms.

Factor in All Costs: Beyond the mortgage, get firm quotes for homeowners insurance—it's a huge factor in Florida. Also, investigate potential HOA fees.

Think Long-Term: Given potential short-term price adjustments, plan to own the home for several years to ride out market fluctuations and build equity.

For Potential Sellers 🏷️

Price Realistically from the Start: The days of multiple over-asking offers are largely gone. Competitive pricing based on current comparable sales is essential.

Maximize Your Home's Appeal: With more competition, ensure your home is well-maintained, clean, and attractively presented.

Be Prepared for a Longer Sale: Homes are taking longer to sell. Patience and flexibility might be necessary.

For Current Homeowners (Not Selling) 🏠

Manage Rising Costs: Focus on budgeting for higher insurance premiums. Explore mitigation options that might lead to discounts.

Focus on Long-Term Value: While rapid equity gains are slowing, homeownership remains a solid long-term investment.

Stay Informed & Prepared

Before making any decisions, especially regarding a property purchase, it's wise to research local conditions thoroughly.

The City of Palm Bay provides resources on flood information, including access to FEMA flood maps.

Brevard County offers an interactive flood zone map that can provide property-specific details.

Utilizing these resources can help you understand potential environmental risks and associated costs.

📰 In Summary: A Market in Transition

The Palm Bay housing market is clearly transitioning away from the intense conditions of recent years. This "correction" phase means more inventory, longer sale times, and increased negotiating power for buyers. While a severe crash isn't the prevailing forecast, further price softening is possible due to ongoing affordability challenges and increased supply. This new environment offers both challenges and fresh opportunities for those involved in Palm Bay real estate.

Curated by AI and fact-checked by The Palm Bayer.

I don't see a lot of houses for sale. If there is, supply & demand dictates that it will trend prices downward which will make houses more affordable. ( a good thing) I think this is what the above analysis is saying.

Why keep building with all the houses for sale? We have enough empty houses already. WTF