Palm Bay's Affordable Housing Crunch: When 'Affordable' Isn't Affordable

Palm Bay residents grapple with rising housing costs, highlighting the gap between official definitions and real-world affordability.

Palm Bay, FL -- The phrase "affordable housing" is frequently tossed around in discussions about housing policy and community development, but what does it truly mean for the average Palm Bay family? A closer examination reveals a growing disconnect between the official definition of affordability and the harsh realities faced by many residents.

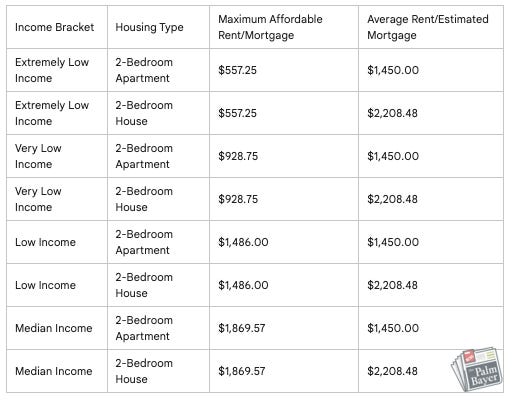

The Department of Housing and Urban Development (HUD) defines affordable housing as costing no more than 30% of a household's income. However, in Palm Bay, where the median household income is $62,319, this definition paints a misleading picture.

Recent data shows the median home sale price in Palm Bay at $345,000. Even with a 20% down payment and a 30-year fixed mortgage at 7%, the monthly mortgage payment, inclusive of property taxes and insurance, would be approximately $2,200. This means a household would need to earn at least $88,000 annually to comfortably afford the median-priced home in Palm Bay.

Renters aren't exempt from these challenges. The average rent for a two-bedroom apartment in Palm Bay is $1,450. To avoid exceeding the 30% threshold, a household would need an annual income of at least $58,000.

These figures highlight the widening chasm between housing costs and income levels in Palm Bay. For a significant portion of the population, especially those in lower-income brackets, finding truly affordable housing is an increasingly daunting task.

Beyond the 30% Rule: The 'Hidden Costs' of Housing

The 30% rule, while useful, neglects to factor in the numerous other expenses associated with housing. Utilities, transportation, and childcare can significantly impact a household's budget, further straining their capacity to afford housing.

Consider a single parent with one child. They might face additional monthly costs of $1,300 for utilities, transportation, and childcare. Even if they secure an apartment that technically meets the 30% rule, they may still struggle to cover all their basic needs.

The Affordability Matrix: A Stark Reality

The following matrix illustrates the affordability challenges in Palm Bay, considering various income levels, housing types, and the impact of additional costs. The Area Median Income (AMI) for Palm Bay is $74,100 for a family of four.

Extremely Low Income: Below 30% of AMI (Annual income below $22,230)

Very Low Income: 30-50% of AMI (Annual income between $22,230 and $37,050)

Low Income: 50-80% of AMI (Annual income between $37,050 and $59,280)

Median Income: Around the Median Household Income for Palm Bay ($62,319)

City Council Takes Action

Recognizing the pressing need for affordable housing, the Palm Bay City Council has taken steps to address this issue. In a recent special council meeting, they approved $5 million in funding for affordable housing programs, utilizing federal American Rescue Plan Act funds. This decision was covered in detail in our previous article, "Palm Bay City Council Meeting: Streetlights, Impact Fees, and Affordable Housing".

Councilman Kenny Johnson stressed the urgency of the situation, stating, "This is something that needed to be addressed years ago, but we have the opportunity now." The council's decision reflects a growing awareness of the challenges faced by residents and a commitment to finding solutions.

The city has also partnered with local nonprofits like Community of Hope to increase affordable housing opportunities. These partnerships aim to provide not just housing but also supportive services to help individuals and families achieve stability and self-sufficiency. You can read more about these efforts in our article "Investing in Community: The Backbone of Palm Bay's Funding Strategy".

The Road Ahead

While these initiatives represent a positive step, addressing the affordable housing crisis in Palm Bay will require ongoing effort and collaboration. Mayor Rob Medina acknowledged the long-standing nature of the problem during a recent council meeting, as detailed in "Palm Bay City Council Meeting: Community Concerns and Big Decisions Dominate the Agenda", saying, "This challenge that we’re facing with affordable housing has been increasing year to year."

The city council's recent allocation of funds demonstrates a willingness to invest in solutions. However, it's clear that more needs to be done to bridge the gap between housing costs and incomes, and to ensure that all Palm Bay residents have access to safe, decent, and affordable housing.

For more information on Palm Bay news & events, be sure to visit The Palm Bayer.

I think trying to include childcare and transportation into housing is not correct since they would exist outside of owning or renting.

The cost of insurance, even renters need homeowners insurance, the cost of utilities is mentioned but breaking it down, you have electricity, water, sewer, trash collection, maintenance, and repairs.

The expenses that trap most on a limited budget are the longer term costs; roof replacement, Heat Pump/HVAC replacement, window replacement, pool resurfacing, screen enclosure repair and screen replacement. Every one of these items starts at $10,000 and goes up from there.

The cheap things are the washers, dryers, refrigerators, dishwashers, ovens, water heaters. The life expectancy of those are 6-10 years and are $1500 each.

Add on to that the cost of insurance deductibles when something catastrophic happens, the rent you pay to own a house, called property taxes that you can never stop or assign a dollar amount to year over year.

Even the items that impact the property owners will impact the tenant since those costs are passed down.